31+ certified letter from irs audit

The fear of an audit has become a bugaboo for American taxpayers. The vast majority of them correct simple oversights or common filing errors.

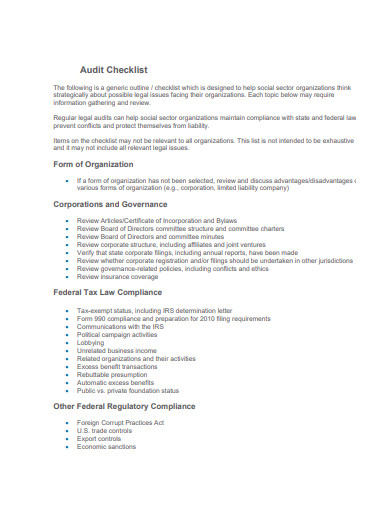

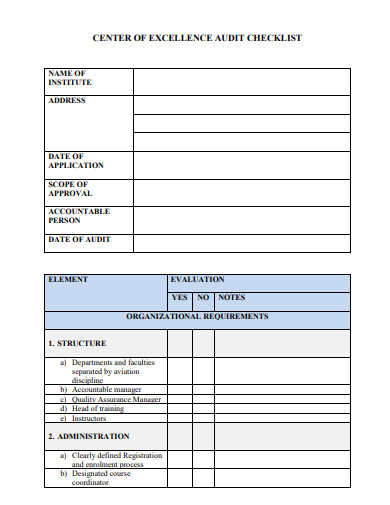

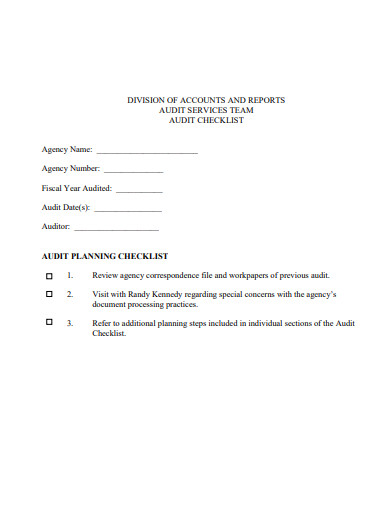

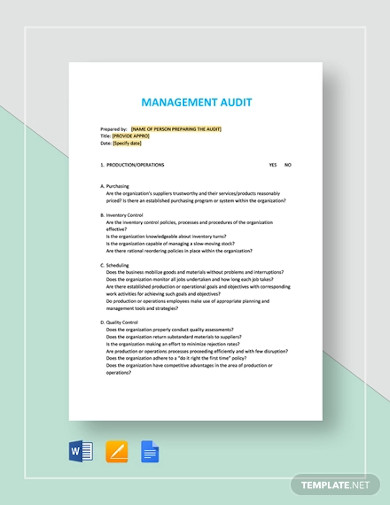

15 Sample Audit Checklist Examples Internal Quality Financial Examples

How does the IRS notify you of an audit.

. The same letter from the IRS is sent to businesses and individuals and they are only sent through certified mail. Only about 11 percent of all tax filers were audited by the Internal Revenue Service last year. No one likes getting a notice from the IRS unless it is a sizable tax refund check.

Sometimes if the IRS assigned an IRS employee to work on your case this IRS employee may manually send you a letter through certified mail. Shes been a waitress for about 10 years so it was no surprise to me when she got a certified letter today from the IRS. If when you search for your notice or letter using the Search on this page it doesnt return a result or you believe the notice or letter looks suspicious contact us at 800-829-1040.

Although I assume its an audit notification Im still curious. Certified Letter From Irs Why Sent Mail Here S The Best Way To Deal With Certified Mail From Irs Irs Notice Audit Letter 3572 Understanding Irs Audit Letter Cp2501 Sample 1. Have a nice weekend.

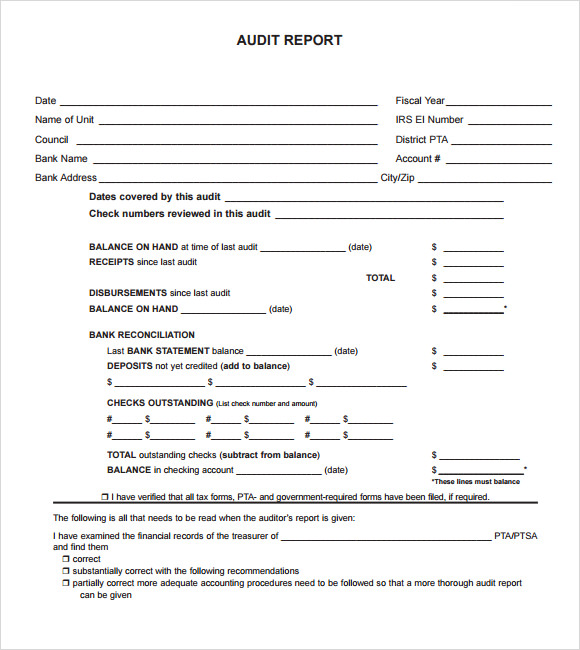

The IRS will also explain the primary focus. An IRS audit letter is certified mail that will clearly identify your name taxpayer ID form number employee ID number and contact information. During the audit process a letter is sent requesting information or clarification.

An IRS audit letter is certified mail that will clearly identify your name taxpayer ID form number employee ID number and contact information. A certified letter from the IRS can really save a taxpayer time and money so read it carefully. It could just be another demand for payment letter for the 291.

In reality though the IRS sends certified letters for many reasons. STREET ADDRESS GRANGER IN 46530-6224. CP-501 This is one of the most common notices sent out.

Heres what you need to do if you receive one. 112004 BROOKHAVEN IRS CENTER - - 08102009. You can always call the IRS prior to signing for the letter to see what it is about.

The IRS will not send these notices by email or contact you by phone. An irs audit letter is certified mail that will clearly identify your name taxpayer id form number employee id number and contact information. Tax audits are not conducted through the phone.

Dont overreact to getting a letter from the IRS. The number of IRS audits is picking back up. If more time is needed to gather documentation a taxpayer can call the assigned auditor and ask for an extension.

You owe tax to the IRS after an audit a penalty assessment or a tax return with a balance due was filed. 4 B Form Ten Unexpected Ways 4 B Form Can Make Your Life. For example the first line of text might say We have selected your state or federal income tax return for the year shown above for examination.

There are a variety of issues that can come up during an audit. Taxpayer Advocate page on notices. Does it mean audit.

What would IRS send via certified mail. Please note that certified mail from the. If you determine the notice or letter is fraudulent please follow the IRS assistors guidance or visit our Report Phishing page for next steps.

If you disagree with the changes proposed by. This is easier said than done. Thats around 16 million people.

One obvious explanation is that audits are rather rare. A certified letter from the irs is simply a form of notice from the irs. Some IRS notices are sent via certified mail such as the Notice of Intent to Levy while others are mailed via regular post like changes made to your tax return.

For example when the IRS audits you the IRS assigns an Auditor to review your tax records. The IRS notifies taxpayers of audits exclusively by mail. Mostly an IRS computer automatically sends IRS letters including certified mail.

Also before you start to panic due to the certified letter from the IRS it is important to understand what an audit letter really is and what it should not be. Of the Internal Revenue Code that a notice of claim disallowance be sent to me by certified mail for any overpayment. The reason this IRS notice is certified is because the IRS is statutorily required to give you notice in person or.

SP1A Page 2 CP2000 Rev. Certified letter from irs why certified mail from the irs irs notice audit letter 3572 irs audit letter cp2501 sample 1. The IRS sends a letter requesting additional documentation to support a deduction or other tax break youve taken.

The delay on audits ended on July 15th and IRS is sending out these letter 6323 notices right now. That letter could be an audit letter but it could also be a letter asking for identity verification before the IRS releases a tax refund. Publication 3498-A The Examination Process Examinations by Mail PDF.

These may involve PPP loans or EIDL. Most IRS audits are conducted through the mail and are relatively routine. Other Information on Notices Letters and Audits.

Do not ignore any of them. Anyone ever get one of these certified letters. 1 Jeremiah Nov 13 2008.

Ok then the certified mail is the notice asking if you want to contest it. The IRS has already filed the lien if you have received this letter. On the other hand it could for something else.

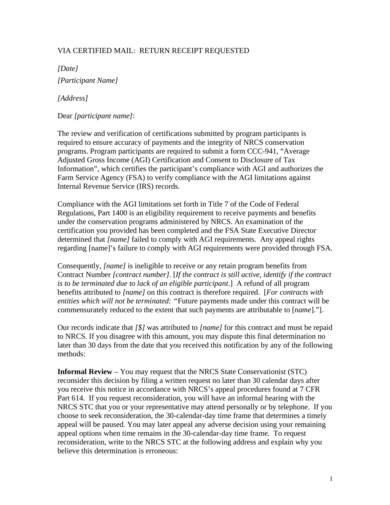

A letter from the IRS is serious business. A 30-Day letter is sent to a business when the IRS has audited a business tax return or prepared a return for the business. It isnt often one gets to say something nice about the IRS but how cool is it that they not only had off-hour service but were able to dig all the records up in real time and settle my worst fears over the.

Read all IRS letters and notices you receive both certified and via regular mail. Remember that the IRS sends out millions of these correspondence audits each year. An irs audit letter will come to you by certified mail.

XXXXXX Increase in Tax 4025. Most letters request a response within 30 days from date of the letter. It is known as a 30-day letter because they give the taxpayer 30 days to respond before the IRS processes the changes made to the return and sends a bill for the balance due.

Publication 556 Examination of Returns Appeal Rights and Claims for Refund PDF.

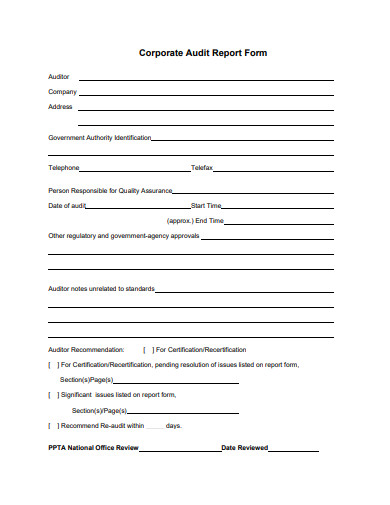

15 Sample Audit Checklist Examples Internal Quality Financial Examples

15 Sample Audit Checklist Examples Internal Quality Financial Examples

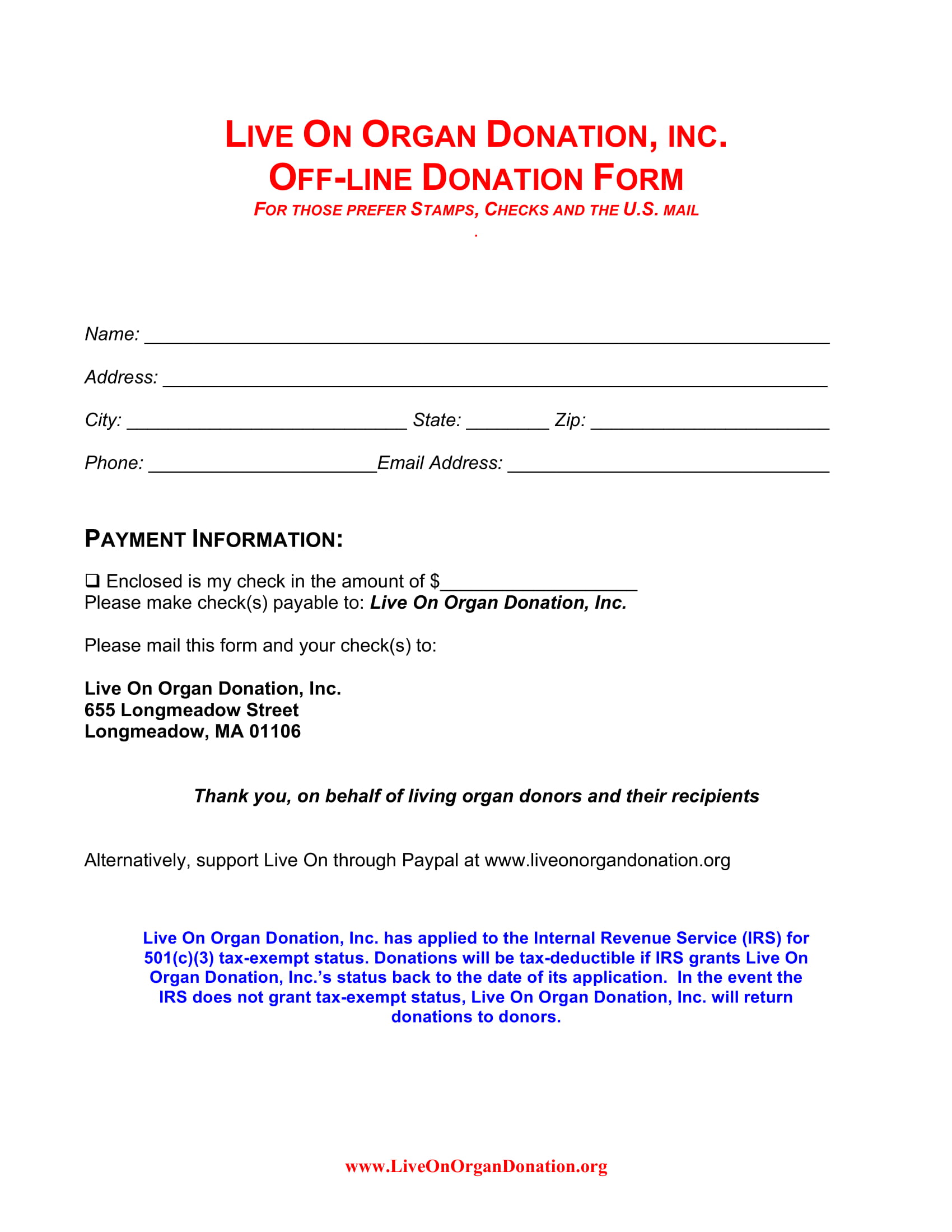

Free 4 Organ Donation Forms In Pdf

Irs Audit Letter Irs Lettering 2017 Printable

Irs Audit Letter Cp75a 2017 2018 Letter Templates Writing A Cover Letter Letter Templates Free

Free 5 Debt Collection Letters In Pdf Ms Word

Irs Audit Letter Sample Audit Follow Up Template Awesome Inside Irs Response Letter Template 10 Professional Templa Letter Templates Letter Sample Lettering

Accountant Hialeah Turbo Tax Irs Audit Letter Must Read To Under Sta Free Basic Templates Tax Debt Audit

15 Sample Audit Checklist Examples Internal Quality Financial Examples

15 Sample Audit Checklist Examples Internal Quality Financial Examples

The Finest April Fools Prank The Fake Irs Audit Letter With Free Downloads April Fool S Prank April Fools Pranks April Fools